Customer Experience Comes of Age

By Brewer Stone, Partner, Nfluence Partners

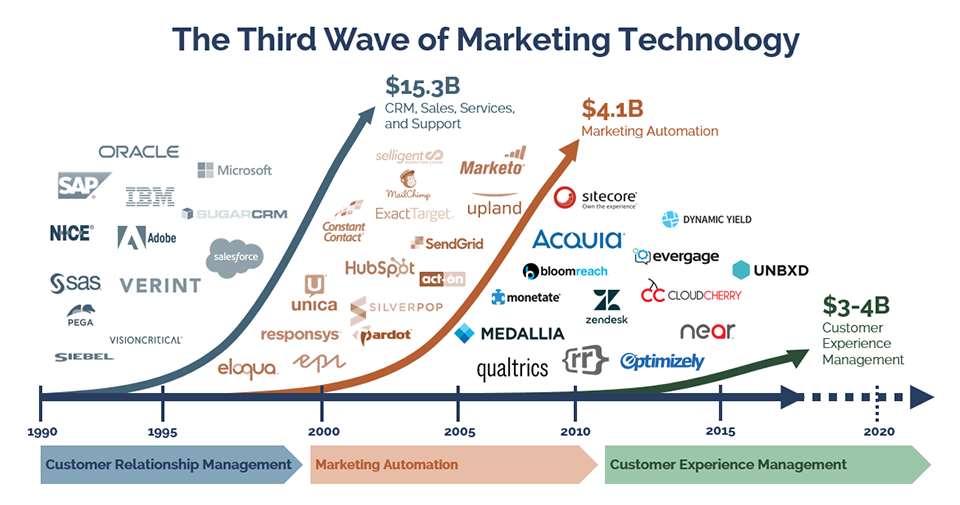

It is a fascinating time to be tracking the analytics-driven Customer Experience (CX) industry. CX technologies improve companies’ ability to manage and enhance the full customer lifecycle, with the aim of bolstering key performance metrics including revenues and customer satisfaction.

The CX space is now well into a classic cycle of consolidation and growth replicating earlier waves in CRM and marketing automation. You know the cycle: Next-generation technologies are funded in thoughtful anticipation of expected trends, in some cases they get richly valued, and then they seek to scale and fully realize product-market fit. In CX, the funding cycle accelerated around 2013-15, and we believe the consolidation is getting under way, with notable recent acquisitions by SAP (Qualtrics), Kibo (Certona), and Verint (ForeSee).

Some key themes in this growth and emerging consolidation trend include:

- The imperative for companies to fully understand and engage with the entire customer journey

- Expanding emphasis on client self-service and product ease-of-use

- Greater thematic focus on true personalization and granular individual level insights

- The massive amount of data available to companies from CRM, marketing and commerce platforms, and third-parties provides greater understanding of demand and intent

- The emergence of customer data platforms (CDP) enables companies to de-silo their data, leading to understanding and uses of CX data and responses across commercial organizations

- A shift from on-premises/hybrid-cloud toward all cloud

- Deeper application of AI and ML technologies

As the slide below indicates, CX can be viewed as the third wave of marketing technologies, with MarketsandMarkets estimating the sub-sector is expected to generate $17 billion in revenues by 2022.

_______

Sources: Gartner, Marketsandmarkets, Nfluence Partners, Pitchbook

For quality growth stage companies in this segment, now is a critical time to take stock and ask the question: Do I raise and deploy the capital needed to build out my own sales, support, channel and customer success capabilities, or do I explore M&A, realize value for key stakeholders, and scale my platform within a larger partner? Given the rapid evolution of this space and the relatively limited number of active consolidators, this topic should be on the boardroom agenda for all companies with best-of-breed capabilities.

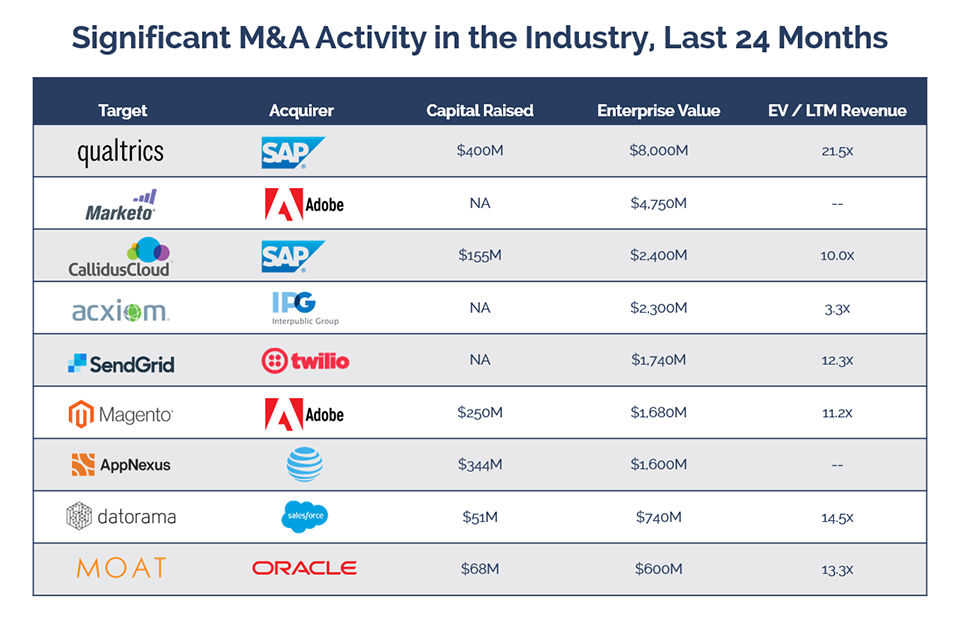

Consolidation certainly is a trend right now. In the last two years alone in CX and adjacent spaces, Adobe has bought Magento Commerce (for $1.7 billion) and Marketo (for $4.75 billion), while SAP paid $8 billion to acquire survey and feedback company Qualtrics. Salesforce added AI-powered marketing performance intelligence and analytics with the acquisition of Datorama. Microsoft and Zendesk also are key players in the space, and companies in the customer support space are also actively exploring opportunities. Some of these companies include Verint Systems (which acquired ForeSee Results for $64.9 million), Cisco (which bought Accompani for $270 million) and Nice (which acquired Mattersight for $103 million), among others.

_______

Source: 451 Research, LLC, Pitchbook; arranged in descending enterprise value

We predict current consolidation will continue and be built around nodes centered on established leaders seeking to extend the capabilities in the following CX subsectors:

- Cross platform / omnichannel personalization

- Voice of the Customer / Customer feedback management

- Customer data platforms

- Real-time website and mobile experience optimization

- Integrated location analytics

- Integrated loyalty programs

We work with numerous emerging companies in these segments that are seeing accelerating growth. A few also are facing challenges with churn as clients experiment with different solutions and seek more integrated and wholistic solutions. In this context, active development of channel partnerships should be a minimum objective, and thoughtfully orchestrated consolidation can—under the right circumstances—enable all constituencies to win.

Should you or one of your companies be considering evaluating their growth strategies or strategic alternatives, please feel free to contact any of us for our thoughtful opinions.

Brewer Stone

Partner

brewer@nfluencepartners.com

Gary Moon

Managing Partner

gary@nfluencepartners.com